Sorry, Jerome Powell, the Fed Is and Has Always Been Political

By Andrew Moran

LibertyNation.com

The history of the Federal Reserve is a tale of corruption, manipulation, and central planning. The U.S. central bank is the chief cause of the booms and the busts, the recessions and the depressions. For the last century, every official emanating from the Eccles Building claims that the Fed is and has always been an independent institution, without any interference from the White House and Capitol Hill. If you think that’s true, then we have a $4.5 trillion balance sheet that we want to sell to you.

Fed Chair Jerome Powell recently spoke in Stockholm, where he delivered prepared remarks stressing the importance of Fed independence. He acknowledged that public confidence in public institutions is at an all-time low, and that bodies like the Fed need to avoid taking their independence for granted.

Fed Chair Jerome Powell recently spoke in Stockholm, where he delivered prepared remarks stressing the importance of Fed independence. He acknowledged that public confidence in public institutions is at an all-time low, and that bodies like the Fed need to avoid taking their independence for granted.

His comments came after Kevin Warsh, a former Fed governor and President Donald Trump’s top candidate to helm the central bank, suggested that the White House does not respect Fed neutrality.

“In some sense the broader notion of an independent agency, that’s probably not an obvious feature to the president,” Warsh told Politico.

But can anyone blame President Trump if he doesn’t view the Fed as a non-partisan body? If Warsh’s assessment is correct, then the president is likely considering its 100-year history of working with Democratic and Republican administrations to steer the economy in a certain direction for political gain.

Trump Slams the Fed in 2016

Throughout the 2016 election campaign, the real estate billionaire mogul was one of the few presidential candidates to slam the Federal Reserve. Although he changed his mind a few times, whether it was low interest rates or his opinion of Janet Yellen, he routinely slammed the Fed. He even took the thunder away from Senator Rand Paul (R-KY), whose father crusaded against the Fed.

Trump’s biggest gripe about the Fed was its political nature. In September 2016, Trump told CNBC that the Fed is beholden to political interests, explaining that it kept rates too low for too long to produce a “false stock market” for then-President Barack Obama.

Yellen denied the allegations, telling reporters that “partisan politics plays no role in our decisions.”

Yellen denied the allegations, telling reporters that “partisan politics plays no role in our decisions.”

When his accusation made headlines, a few people came to the rescue, including former Representative Ron Paul (R-TX), calling it “an open secret in Washington”:

“The Fed’s involvement in the ‘political business cycle’ is a well-documented fact. The Fed tends to loosen before elections and is far more likely to tolerate downturns between presidential elections and Fed appointments. This is an open secret in Washington. We all pretend that the Fed is not a political operation, and yet everyone knows that it is among the most political institutions in the entire government.”

CNN attempted to refute Trump by posting some good old-fashioned fake news with a video, titled “Why the Federal Reserve isn’t political.” The Counterfeit News Network’s Christine Romans read something from a government-approved textbook that was obviously detached from reality.

History of the Fed’s Political Power

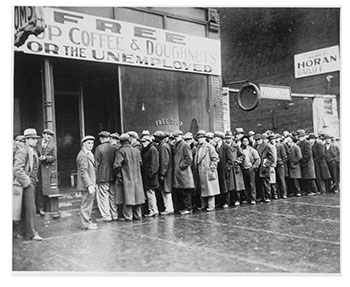

The Fed’s partnership with Washington commenced in the 1930s, when Marriner Eccles, the seventh chairman of the Fed, “coordinated” monetary policy with President Franklin Delano Roosevelt’s administration policies. Ostensibly, like so many Americans back then, Eccles immensely admired FDR and he evidently wanted the Keynesian prescription to cure the nation’s woes. Unfortunately, the Great Depression went on longer than it needed to, thanks to FDR and the Fed.

The 1960s and 1970s were great times for the White House-Fed tag team.

Fed Chair William Martin was pressed by President John F. Kennedy to speed up money creation. Martin acquiesced to the request, and the money supply expanded by 3%. Kennedy’s successor, President Lyndon Baines Johnson, needed faster money printing to cover the costs of the Vietnam War. Once again, Martin approved the demand, and money creation topped 5%.

Not to be outdone by their Democratic rivals, Republican presidents joined in on the fun. When Arthur Burns became head of the Fed, the administration of President Richard Nixon needed money to flood the economy to fight stagflation, buoyed by price and wage controls of 1971. The printing press printed as much as 10% of new dollars. Moreover, according to Kevin Phillips, a political and economic commentator and one-time Nixon strategist, Nixon ordered Burns to establish a new inflation figure that would make it seem less intimidating. This became known as “core” inflation.

When President Gerald Ford took over the reins, he informed Burns that he wanted money growth to slow down, prompting Burns to slash it to 4.7%.

The 1990s was also an interesting time for monetary policy and the national economy because Alan Greenspan became instrumental in President Bill Clinton’s initiatives. Clinton viewed Greenspan as a “man we can deal with,” while the administration averred that they had a “gentleman’s agreement” regarding the Fed facilitating its economic initiatives. To help grow the economy, $1.4 trillion of new money was printed between 1993 and 2001. Not only did it fuel the dot-com bubble, it also allowed then-President Bill Clinton to fend off widespread impeachment support for a couple of years.

The 1990s was also an interesting time for monetary policy and the national economy because Alan Greenspan became instrumental in President Bill Clinton’s initiatives. Clinton viewed Greenspan as a “man we can deal with,” while the administration averred that they had a “gentleman’s agreement” regarding the Fed facilitating its economic initiatives. To help grow the economy, $1.4 trillion of new money was printed between 1993 and 2001. Not only did it fuel the dot-com bubble, it also allowed then-President Bill Clinton to fend off widespread impeachment support for a couple of years.

Despite its initial intention to be separate from the three branches of government, the record shows chairmen and presidents have worked together on multiple occasions.

Economist and historian Thomas DiLorenzo wrote:

“The Fed operates for the benefit of its executive branch controllers, the banking industry, and Fed employees themselves, at the expense of the rest of society which suffers from the economic instability it creates. Worse yet, many Americans have been conned into believing that the Fed Chairman operates like the Wizard of Oz, hiding behind dark curtains, pulling levers and pushing buttons to make the economy operate smoothly. So-called ‘scientific socialism’ may have been the most absurd and destructive idea of the twentieth century, but it is nevertheless the guiding ideology of central banking.”

Audit or End the Fed

Since Dr. Paul’s exit from the political arena, there has been very little appetite to audit the Federal Reserve. Senator Paul has renewed legislation to comb through its books, but there hasn’t been much discourse and engagement regarding the Fed’s power and influence. Outside of Paul’s efforts, the only concern among certain members of Congress is the skin complexion of Fed members, not monetary policy. The Eccles Building has a new chief occupant, but interest rates are still manipulated and the printing press rolls on.