Blackstone Prepares A Record $50 Billion To Snap Up Real Estate During The Coming Crash

The past two months have seen a barrage of negative news coverage focusing on the US housing market...

-

The One Housing Chart That Shows A 'Buyer's Market' Has Returned

-

As Mortgage Rates Explode Price Cuts Soar And Buyer Demand Collapses

-

Housing Market Peaks: Home Prices Finally Drop From All-Time Highs

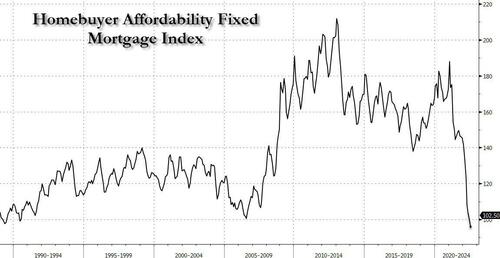

... which is predictable: after all, with mortgage rates soaring at the fastest pace on record to decade highs, and sending US housing affordability to the lowest in history...

... only a handful of the "1%" can afford the American Dream.

Alas, it also means that just like in 2007, a housing crash is now just a matter of time.

That much is known. What is also know, is that once housing craters, the largest US residential and commercial landlord - private equity giant Blackstone - is about to get even bigger. That's when it will deploy some (or all) of the record $50 billion in dry powder it has raised to prepare for just the coming housing crash.