11 Million At Risk Of Losing Their Homes Once COVID Protections Expire

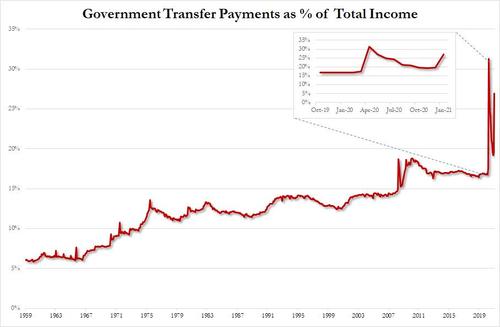

With the Federal government supercharging the US consumer with now periodic massive stimulus payments - $900 billion here and $1.9 trillion there - and universal basic income handouts, it's hardly a surprise that the US economy, where the government is now responsible for a staggering 27% of all personal income...

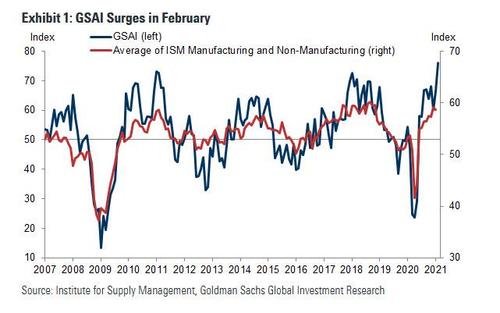

... is redlining to the point of overheating as Goldman found recently when its latest Goldman Sachs Analyst Index (GSAI) which provides a snapshot perspective on the US economy, hit an all time high.

None of this is a surprise: when money literally drops from the sky, it would be a miracle if the economy wasn't overheating. The question is what happens when the party stops. Unfortunately for some 11 million people, the hangover will be a disaster.

According to a new report issued by the CFPB on Monday, the number of homeowners that are behind on their mortgage has doubled since the beginning of the pandemic, with 6% of mortgages in delinquency as of December 2020. The consumer protection bureau found that total of 2.1 million mortgages are considered “seriously delinquent,” with borrowers more than 90 days behind on making their payments, and in addition, an estimated 8.8 million tenant households are behind on their rent.

While COVID-19 relief programs have reduced the number of foreclosures and evictions thus far, the bureau estimated that 11 million families could be at risk of losing their homes as COVID-19 relief measures expire, ABA Banking Journal calculated . As of January 2021, there were 2.7 million borrowers in active forbearance—and of those, more than 900,000 will have been in forbearance for over a year as of April 2021.

The CFPB also noted that 263,000 seriously delinquent borrowers have not taken forbearance to date, and warned that should COVID-19 relief options expire before they do so, they would have limited options to avoid foreclosure. On a positive note, however, the bureau found that “most borrowers that have exited forbearance have been able to resume their payments without issue.”

That's hardly encouraging to the 11 million or so who will end up homeless if and when the generous covid benefits finally expire.