By Pamela Geller

GellerReport.com

Staple Street owns Dominion and is a relatively small private equity company, who has not raised capital or had substantial new investors since 2014/2015 of about $200 million. But now after a rushed Delaware Corp., filing October 5, 2020, Staple notified U.S. SEC 10/08/20 they’re expecting $800 million minimum. Yet Staple Street’s website is suddenly shut down, except for the base page.

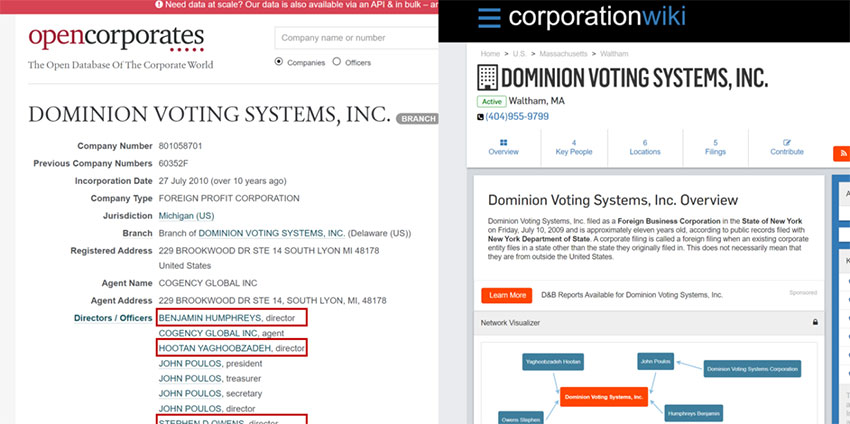

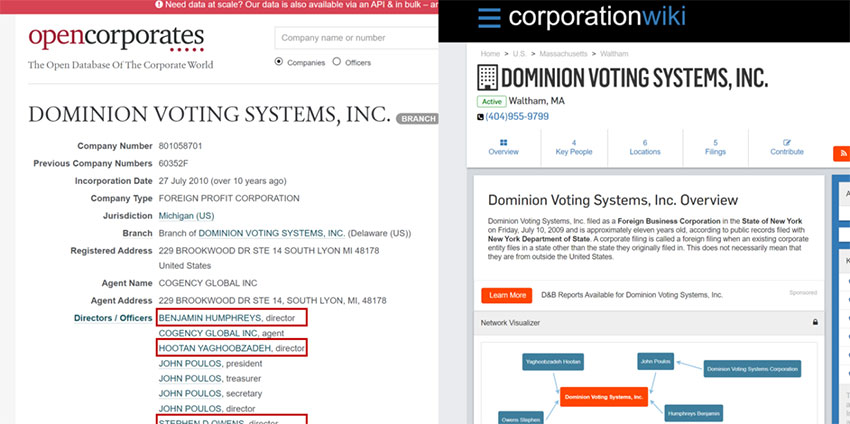

Staple Street Capital is a private equity firm founded in 2009 based in New York. The co-founders Stephen D. Owens and Hootan Yaghoobzadeh are veterans of The Carlyle Group and Cerberus Capital Management, also the Board members of Dominion Voting. The official website of Staple Street Capital has deleted the team introduction.

It is absurd and outrageous that a United States elections system is hidden inside of a NY private equity fund.

Staple Street Capital, which acquired Dominion Voting, has shutdown most of their site. Oddly suspicious is the important portfolio holdings description page which was present a week ago. October 08, 2020 Staple Street capital has filed with the United States SEC, Securities and Exchange Commission, for a capital raise of $800 million – not a good time to shut down a Private Equity investment firm’s website.

Background: Staple Street Capital LLC operates as a private equity firm and was founded not long after Obama took office in June 2009. A United States election voting system was acquired by a Private Equity/hedge fund. That should never be allowed By U.S. SEC. It produces extreme conflicts of interest and unlike publicly traded companies, are cloaked in privacy.

Dominion Voting Systems (“Dominion Voting”) was acquired Staple Street Capital, a leading New York-based, middle-market private equity firm in July 2018. Staple Street also recently acquired Ivy Technology and CyberLink.

Staple Street has not filed an SEC form D since 2015 for $200 million capital raise… Now October 2020 they are raising $800 million? Also 10/27 another Fund incorporation pending in Delaware, yet Staple Street website is suddenly shut down.

$400 million each filed October 8 with the “incorporation” in Delaware of October. There is a third one pending, that is a massive sudden amount of activity for relatively small firm.

Staple Street owns Dominion, and are clients of Kirkland and Ellis. Should such conflict have been disclosed to Pennsylvania and whomever else? Extremely unusual is Kirkland and Ellis represented both sides in Staple Street’s 2019 acquisition of Ivy technologies – a company which should be nowhere near a United States election system – Let alone owned by the same Staple Street capital. Also acquired more recently with CyberLink – No wonder the private equity firm has shut down their site describing their portfolio company holdings.

Page 26 notes Dominion Ownership change disclosure, hidden in private equity firm Staple Street – now the website has been mostly shut down.

Chicago.CookAmendDominion(1)

Headquartered in Dallas, TX, Cyberlink provides a robust suite of managed IT services that allow enterprise customers to simplify their technology infrastructure, seamlessly scale operations and improve their IT responsiveness. The Company’s value proposition and high service levels have resulted in a long-tenured, diversified customer base spanning more than 800 customers across more than 10 end markets. With a presence in 46 states, Cyberlink’s flexible, cloud-agnostic delivery model enables the Company to efficiently serve customers across the U.S.

Cyberlink’s Founder and CEO, Christopher Lantrip, said “We are excited to partner with Staple Street on the next phase of growth for Cyberlink. This new partnership will provide additional resources and support to help us continue to expand our service capabilities for new and existing clients.”

The partners from Staple Street Capital said “Cyberlink is a highly attractive platform opportunity given the Company’s established market position, entrenched customer relationships and seasoned management team. We look forward to partnering with Chris and the entire Cyberlink team to build upon this foundation to support continued growth.”

Staple Street was advised by McDermott Will & Emery LLP. Cyberlink was advised by Focus Strategies Investment Banking and Jones & Spross, PLLC.

Cyberlink

Founded in 1999, Cyberlink is a Dallas-based managed IT services firm providing cloud, managed application, network, storage, desktop and security services on a 24×7 basis to customers across the U.S. Cyberlink serves clients in a range of industries, including healthcare, financial services, legal, logistics and other end markets. For more information, visit www.cyberlinkasp.com.

Staple Street Website page with description of owned companies is now shut down… Ivy technology International and CyberLink were purchased within the past 18 months with Dominion acquired in 2018

Staple Street Capital Acquires iQor’s International Logistics and Product Service Assets

Ivy Tech

NEW YORK, NY — June 3, 2019 – an affiliate of Staple Street Capital L.L.C. (“Staple Street Capital”), a leading middle market private equity firm, has acquired certain logistics and product service assets in a corporate carve-out transaction from affiliates of iQor Holdings Inc. (“iQor”). The acquired businesses include iQor’s operations located in Europe, Asia, South America, Canada and certain facilities located in the United States (the “Company”). In conjunction with the acquisition, the Company will be renamed Ivy Technology.

Built on a foundation of executional excellence and innovation, Ivy Technology is a leading provider of aftermarket lifecycle solutions for electronic equipment. With approximately 2,900 employees across the globe, the Company provides electronic product repair services to many of the world’s leading computer, electronic, telecommunications and medical device companies.

The partners of Staple Street Capital said, “We are excited to partner with Ivy’s management team to provide the strategic and capital resources to enable a long term growth strategy that will now be purely focused around meeting the objectives of our newly formed standalone company. We look forward to further investing in Ivy Technology in order to meet the highest standards of customer care and quality, and to further innovate new value-added services and solutions for customers.”

Kirkland & Ellis served as legal advisors to both Staple Street Capital and iQor Holdings in this transaction.