You Can't Bank On The Bankers

You Cannot Bank On The Bankers.

Well, you can bank on them screwing you!

It's time to focus on the single biggest source of the problems we are facing, the bankers. The banking system we are forced to use is absolutely corrupt from top to bottom. It is utterly fraudulent by design. This system provides a small handful of the worst kind of people the single largest unfair advantage against everyone else ever devised. It also provides the single most powerful means to enslave humanity.

It's time to focus on the single biggest source of the problems we are facing, the bankers. The banking system we are forced to use is absolutely corrupt from top to bottom. It is utterly fraudulent by design. This system provides a small handful of the worst kind of people the single largest unfair advantage against everyone else ever devised. It also provides the single most powerful means to enslave humanity.

One of the primary institutions the bankers set up to orchestrate their fraud is the Federal Reserve Banking System. Many still have no idea that the Federal Reserve isn't any more Federal than Federal Express. Look it up in the phone book. It's not in the blue pages folks. It's a totally private corporation set up by the bankers for the bankers. It was not setup for our benefit. It was established to force us all into their corrupt system. The Federal Reserve System is the means they've used to institutionalize and legitimize the fraud they've been committing for almost 100 years now.

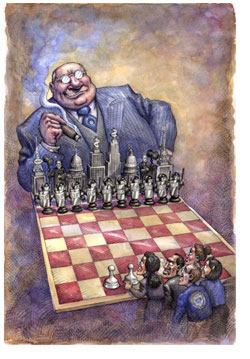

The central fraud of this lovely system they cooked up is something called "fractional reserve banking." In a nutshell, it's a nifty little device that allows bankers to claim they have more money than they really have. Lots more money than they really have. For example, if you were a bank and I deposited one million dollars in your bank, you would get to say you have ten million dollars. Isn't that wonderful? You didn't have to do anything to actually earn that extra nine million dollars. Just because you're that special breed of person called a banker, you get to do that. Then you get to lend out those nine million dollars to other people and charge interest on it. If the people can't pay you back for some reason, you get to take whatever "real" assets they had put up as loan collateral. Of course, you never tell those you lent the money to that you acquired the money through a fraudulent process.